More than one in ten UK mortgage holders plan to delay buying or selling a new home in the next year. Nearly one in three are worried they will fail to make mortgage repayments in the same time period. Legal professionals that rely on transaction volume will need to find ways to shield themselves against today’s volatile property market – and technology may be the answer.

Recession worries and rising interest rates are weighing heavily on mortgage holders across the UK and impacting their property expectations, financial wellbeing and mental health.

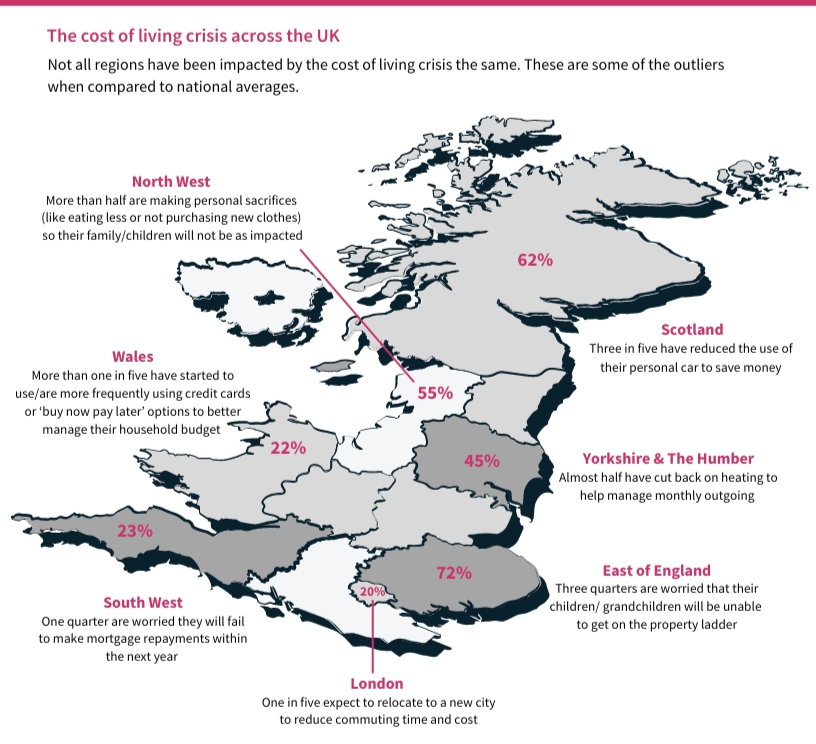

According to a new survey of 2,000 UK mortgage holders conducted by Danebury Research on behalf Dye & Durham, three quarters (76%) believe the UK is either already in a recession or about to enter one. In fact, more than half (56%) say the current cost of living crisis is impacting their mental health, and concerns about individual financial stability are prevalent.

Nearly a third of respondents (30%) say they are worried they will fail to make mortgage repayments within the next year. At the same time, more than a third (36%) said they could only afford to continue paying their mortgage for two months if a job loss affected the main breadwinner – a possible warning sign of rising repossessions within the UK property market. And two in five (40%) say they’ve gone so far as to cut back on heating during the winter months to help manage their monthly outgoings.

“The effects of high interest rates, energy bills and the increased cost of living overall cannot be underestimated. Our survey data show Britons are extremely concerned about both their short- and long-term future and have reduced spending, raided savings and are delaying major purchases,” says Martha Vallance, Chief Operating Officer for Dye & Durham.

The UK saw a considerable uptick in property transactions during the height of the Covid-19 pandemic, but those tides have turned dramatically as the cost-of-living crisis has deepened. In fact, one in eight (11%) UK homeowners – and nearly one in five (19%) Londoners – told us they expect to delay selling or buying a home this year.

It’s not just the short-term ramifications of the cost-of-living crisis that are weighing on the average UK homeowner. Nearly seven in ten (69%) mortgage holders say they are concerned about the financial future for themselves and their family. Two thirds (66%) say they’re worried a lack of affordability will prevent their children and/or grandchildren from ever getting on the property ladder.

It’s clear from this data that legal professionals who rely on property transactions to drive revenue will need to adapt to volatile market conditions over the near-to-medium term.

“Now is the time to start evaluating technologies that can help modernize their businesses and help them save money by reducing unnecessary costs,” adds Vallance.

Opportunities in a challenging market

Many UK law firms are still managing much of their operations with manual, paper-based and resource-intensive processes that lack the necessary ease of access and security measures to be truly productive and profitable.

By adopting digital practice management tools, legal professionals can spend more time on revenue-driving tasks and less on non-billable administration like case management, client intake and invoicing. At the same time, they can increase the security of their information, reduce risk and provide a more modernised customer experience for their clients.

The UK property market will face considerable challenges over the near term compared to the past few years, but this too shall pass. The firms that use this opportunity – while transaction volumes are down – to examine their resources and adopt tools designed to digitize and modernize their workflows — and increase their productivity and profitability — will have a significant head start on other firms once the market returns to normal.

Interested in finding out ways you can protect your bottom line against market volatility?

Click here.

About the survey

Using an online methodology, Danebury Research conducted a nationally representative survey of 2,000 UK based homeowners with a mortgage aged between 18 and 65. Fieldwork was conducted from 12th February to 16th February, 2023.